Information Clearing House

By Jomo Kwame Sundaram

March 01, 2016 “Information Clearing House” – “NC” – The Trans-Pacifc Partnership (TPP) Agreement, recently agreed to by twelve Pacifc Rim countries led by the United States,1 promises to ease many restrictions on cross-border transactions and harmonize regulations. Proponents of the agreement have claimed significant economic benefits, citing modest overall net GDP gains, ranging from half of one percent in the United States to 13 percent in Vietnam after fifteen years. Their claims, however, rely on many unjustified assumptions, including full employment in every country and no resulting impacts on working people’s incomes, with more than 90 percent of overall growth gains due to ‘non-trade measures’ with varying impacts.

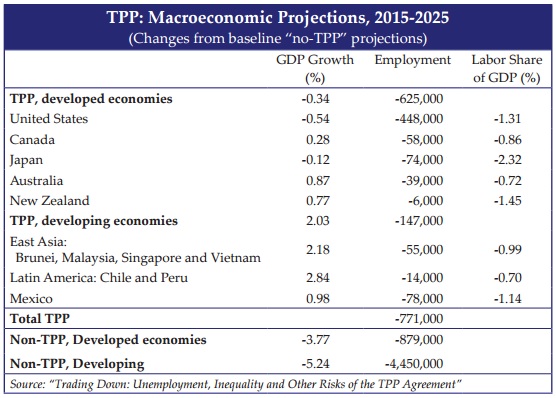

A recent GDAE Working Paper finds that with more realistic methodological assumptions, critics of the TPP indeed have reason to be concerned. Using the trade projections for the most optimistic growth forecasts, we find that the TPP is more likely to lead to net employment losses in many countries (771,000 jobs lost overall, with 448,000 in the United States alone) and higher inequality in all country groupings. Declining worker purchasing power would weaken aggregate demand, slowing economic growth. The United States (-0.5 percent) and Japan (-0.1 percent) are projected to suffer small net income losses, not gains, from the TPP.

This GDAE Policy Brief is intended to help clarify the differences with other modeling studies and to present our findings in a less technical manner.

Flaws in TPP Economic Projections

Optimistic claims about the TPP’s economic impacts are largely based on economic modeling projections published by the Washington-based Peterson Institute for International Economics. Its researchers used a computable general equilibrium (CGE) model to project net GDP gains for all countries involved. These figures have been widely cited in many countries to justify TPP approval and ratification. Updated estimates, released in early 2016 and incorporated into the World Bank’s latest report on the global economy,3 now stress income gains for the United States of $131 billion, or 0.5 percent of GDP, and a 9.1 percent increase in exports by 2030.4

The projections methodology assumes away critical economic problems and boosts economic growth estimates with unfounded assumptions. The assumption of full employment is particularly problematic. Workers will inevitably be displaced due to the TPP, but CGE modelers assume that all dismissed workers will be promptly rehired elsewhere in the national economy as if part of labor ‘churning’. The full-employment assumption thus inflates projected GDP gains by assuming away job losses and adjustment costs.

The modelers also dismiss increases in inequality by assuming no changes to wage and profit shares of national income. Again, this is not supported by empirical evidence, as past trade agreements have tended to reduce labor’s share.

Finally, foreign direct investment (FDI) is assumed to increase dramatically, which contributes a significant boost to economic growth in the Peterson Institute projections, accounting for more than 25 percent of projected U.S. economic gains in the recent update. This assumes that: 1) income to capital owners will be invested; and 2) this will result in broad-based growth. Neither is supported by the evidence. A U.S. Department of Agriculture study,5which did not assume such FDI-related investment gains, found zero growth for the United States and very modest growth elsewhere at best.

The methodology of the Peterson study is flawed; consequently, growth and income gains are overstated, and the costs to working people, consumers and governments are understated, ignored or even presented as benefits. Job losses and declining or stagnant labor incomes are excluded from consideration, even though they lower economic growth by reducing aggregate demand.

Some economists have pointed out6 additional misleading findings in the most recent Peterson Institute update:

• U.S. income gains of 0.5 percent from TPP in 2030 – This is raised from the institute’s previous 0.4 percent, mainly by extending the implementation period from ten to fifteen years. In any case, added growth of 0.5 percent is very small, about 0.03 percent per year over fifteen years.

• Exports rise by 9.1 percent, but so do imports, because the model assumes fixed trade balances. This excludes, by assumption, the problems associated with rising trade deficits, which have been common after previous trade agreements.

• All displaced workers are absorbed immediately and costlessly in other sectors – again, by assumption. The paper does acknowledge that manufacturing employment will increase more slowly because of the TPP, and that some 53,700 more U.S. jobs per year will be “displaced” annually. But they view this as a small addition to normal labor market “churn.”

More Realistic Economic Projections

We employed the UN Global Policy Model (GPM) to generate more realistic projections of likely TPP impacts. Unlike most CGE models, the GPM incorporates more realistic assumptions about economic adjustment and income distribution, assessing the TPP impact on each of them as well as on economic growth over a ten-year period. Importantly, it does not assume large unexplained FDI surges or investment, growth and income gains due to nontrade measures. The modeling results are summarized in the table.

To facilitate comparison, we used the Peterson Institute’s projected estimates of the TPP’s impact on exports, applying the macroeconomic model to assess the efects of projected TPP trade increases.7 The GPM analyzes macroeconomic sectors – primary commodities, energy, manufacturing and services – but does not contain data on single markets (such as car parts or poultry).

The main fndings include:

• The TPP will generate net GDP losses in the USA and Japan. Ten years after the treaty comes into force, US GDP is projected to be 0.54 percent lower than it would be without the TPP. Similarly, the TPP is projected to reduce Japan’s growth by 0.12 percent.

• For other TPP countries, economic gains will be negligible – less than one percent over ten years for developed countries, and less than three percent over the decade for developing countries. Chile and Peru’s combined gain of 2.84 percent comes to only about a quarter of one percent per year.

• The TPP is projected to lead to employment losses overall, with a total of 771,000 jobs lost. The United States will be hardest hit, losing 448,000 jobs.

• The TPP will also likely lead to higher inequality due to declining labor shares of national incomes. In the United States, labor shares are projected to fall by 1.31 percent over ten years, continuing an ongoing multi-decade downward trend.

Conclusions

In sum, the TPP will increase pressures on labor incomes, weakening domestic demand in all participating countries, in turn leading to lower employment and higher inequality. Even though countries with lower labor costs may gain greater market shares and small GDP increases, employment is still likely to fall and inequality to increase.

In fact, most goods trade among TPP countries has already been liberalized by earlier agreements. Instead of promoting growth and employment, the TPP is mainly about imposing new rules favored by large multinational corporations. The TPP greatly strengthens investor and intellectual property rights (IPRs), while weakening national regulation, e.g. over financial services.

The TPP will strengthen IPRs for big pharmaceutical, information technology, media, and other firms, e.g. by allowing pharmaceutical companies longer monopolies on patented medicines, keeping cheaper generics of the market, and blocking the development and availability of similar new medicines.

The TPP would also strengthen foreign investor rights at the expense of local businesses and the public interest. The TPP’s investor-state dispute settlement (ISDS) system will oblige governments to compensate foreign investors for losses of expected profits in binding private arbitration.

These pro-investor measures impose significant costs, especially on developing countries. They will exert a chilling efect on important government responsibilities to promote national development and protect the public interest.

Our modeling suggests that TPP skeptics, concerned about the agreement’s impacts on growth, labor incomes, employment and inequality, have good reason to doubt optimistic projections. Our results show negative impacts in all these areas, particularly in the United States. Legislatures in TPP countries should carefully consider these findings and their implications before approving the agreement.

Jomo Kwame Sundaram, an Assistant Secretary General working on Economic Development in the United Nations system during 2005-15, and was awarded the 2007 Wassily Leontief Prize for Advancing the Frontiers of Economic Thought. Originally published as a Global Development and Environment Institute Policy Brief

Endnotes

1 The participating countries – Canada, United States, Mexico, Chile, Peru, Japan, Vietnam, Malaysia, Singapore, Brunei, Australia and New Zealand – have finalized and signed the text of the agreement, but the treaty must be ratified in all of them before it can come into force.

2 Peter Petri, Michael Plummer and Fan Zhai (2012). “The Trans-Pacific Partnership and Asia-Pacific Integration: A Quantitative Assessment”. Policy Analyses in International Economics 98, Peterson Institute for International Economics, Washington, DC. The Peterson Institute study has also been criticized by others, e.g. http://www.sustainabilitynz.org/wp-content/uploads/2014/02/EconomicGainsandCostsfromtheTPP_2014.pdf.

3 See Global Economic Prospects, Spillovers Amid Weak Recovery, January 2016, The World Bank Group, Washington, DC.

4 Peter Petri and Michael Plummer, “The Economic Efects of the Trans-Pacifc Partnership: New Estimates”, January 2016, Working Paper 16-2, Peterson Institute for International Economics, Washington, DC.

5 See http://www.ers.usda.gov/media/1692509/err176.pdf/a>

6 See, for example, Dean Baker, “Peterson Institute Study Shows TPP Will Lead to $357 Billion Increase in Annual Imports”, January 26, 2016.

7 A robust debate over such modeling followed the release of the GDAE paper, with a critique from Robert Lawrence for the Peterson Institute (“Studies of TPP: Which is Credible?”) and two responses from GDAE: “Are the Peterson Institute Studies Reliable Guides to Likely TPP Effects?” and “Modeling TPP: A response to Robert Z. Lawrence.” GDAE clarifed that the GPM is fully documented in the UNCTAD publication, “The UN Global Policy Model: Technical Description.”

![STARS, WARS, BLOOD & LUST… [The “royal secrets” of the Djedi knights of Scientism]](https://christianobserver.net/wp-content/uploads/2023/11/star-wars-blood-lust-150x150.jpg)